Fortune 500 insurance company uses smart data to detect service delivery problems in the hybrid cloud and quickly troubleshoot them.

We use Netscout to enhance end-user and customer experience with improved network and service availability, reliability and responsiveness.

- Network Engineer at Fortune 500 Insurance Company

Key Insurance Focal Areas

Managing Digital Transformation, Assuring Business Continuity and Availability

Insurance Application Service Assurance

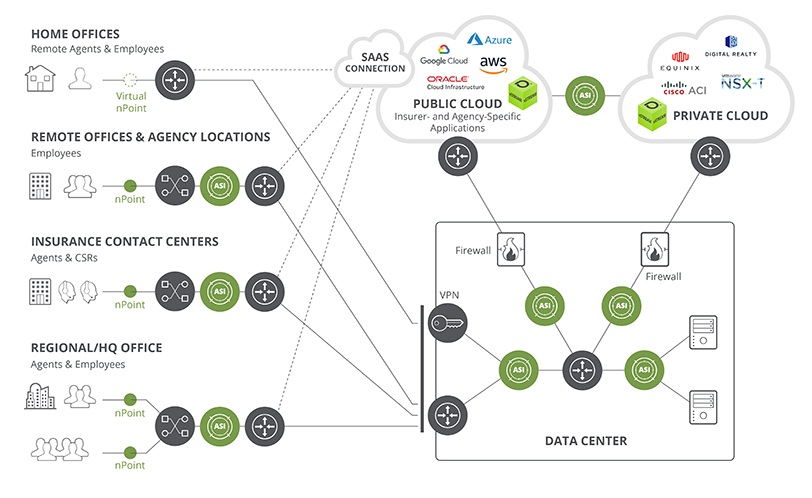

With insurers, agents, and customers requiring access 24x7 access to quotes, claims, policy, CRM, and sales applications, NETSCOUT provides visibility into performance of those apps wherever they reside – on-premises, virtual, multi-cloud, co-lo, or SaaS platforms.

Network Performance Management

nGeniusONE provides visibility into multi-cloud, virtual, co-lo, on-premises, and hybrid environments used by today’s insurance businesses.

Security & Availability

NETSCOUT protects insurers from cyberthreats that can cause loss of clients’ private data, damage to internal applications and databases, and risk in websites and portals due to DDoS attacks.

User Experience Assurance

NETSCOUT visibility and monitoring assures user experience for insurers, agents, and employees across any network infrastructure, for any application, anywhere in the world.

Unified Communications & Collaboration Business Services

NETSCOUT provides vendor-agnostic visibility and real-time monitoring of VoIP, Microsoft Teams, Cisco Webex and Jabber environments, as well as call center environments operating on premises or on CCaaS platforms.

Evidentiary Compliance Management

NETSCOUT smart data and smart analytics ease evidentiary compliance with insurance, financial, and healthcare standards, helping IT reduce regulatory disruption.

Featured Resources

Solutions for the Insurance Industry

The NETSCOUT Visibility Without Borders Approach for the Insurance Industry Leverages the Following Smart Data and Analytics Solutions

nGeniusONE Solution

InfiniStreamNG Appliance

vSTREAM Virtual Appliance

Packet Flow Switches (PFS) and TAPs